Top 10 Tips To Customize Ai Trading Platforms For Your Strategy

AI trading platforms that predict/analyze stocks are well-known for their capacity to modify strategies to meet the requirements of the users. This enables them to adapt to specific trading objectives and conditions, such as risk tolerance. A platform with flexible options for customization can dramatically improve the efficiency of your trading. Here are 10 top strategies for evaluating the customizable options offered by these platforms.

1. Evaluate Pre-Built Strategy Templates

A variety of templates. Check whether the platform has a wide range of strategies pre-built to suit different types of trading (e.g. day trading, swing trading or long-term investment).

You are able to easily modify the templates and tailor them to meet your particular needs.

Performance history: Determine if you can access historical information about the performance of the pre-built strategies.

2. Review the Custom Strategy Development

Drag-and-drop: Find platforms that provide drag-and-drop interfaces to create custom strategies.

Coding options: For users who are more advanced, check if the platform supports custom-written coding in a scripting language that is proprietary (e.g. Python, R).

Flexibility: You should be able define the entry/exit criteria along with risk management parameters as well as other components that are key to your strategy.

3. Check for Backtesting Capabilities

Historical data: Ensure that the platform is equipped with enough historical data to backtest strategies.

Configurable settings: Make sure you have the capability to modify settings during backtesting.

Performance metrics: Check if the platform offers specific performance metrics for backtested strategies (e.g. win rate sharpe ratio drawdown, etc.).

4. Evaluate Real-Time Strategy Testing

Paper trading: Make sure the platform allows you to simulate or test your strategies without risking any money.

Live testing: Determine whether you can test strategies in live markets with very little capital to test their effectiveness.

Real-time adjustments: Check whether you are able to tweak strategies in real-time based on market conditions.

5. Evaluate the integration using technical indicators

Indicator library: Check whether the platform has an extensive collection of technical indicators (e.g. moving averages, RSI, MACD).

Custom indicators: Make sure you are able to design or import custom indicators that you can use in your strategies.

Check the combination of indicators.

6. Check for Risk Management Tools

Stop-loss/take-profit: Ensure the platform allows you to set stop-loss and take-profit levels within your strategies.

Size of the position. Determine whether you can establish rules for the size of positions (e.g. percentage, fixed amount) and manage the risk.

Rate of risk-reward: Check if the platform allows setting specific risk-reward rates for specific strategies or trades.

7. Evaluate Multi-Asset Strategy Support

Asset Classes: Ensure that the platform supports strategies for a variety of asset types (e.g. ETFs and Options, Forex and Stocks).

Strategies for cross-assets: Determine whether you're capable of designing strategies that incorporate different asset classes.

Market coverage - Verify that the platform covers the markets you're in (e.g. US and international markets or copyright and more.).

8. Evaluate Automation and Execution

Automated trading: Ensure the platform is able to automate the execution of strategies based on established rules.

Order types - Make sure the platform supports a variety of order types for execution strategies (e.g. stop limit, market or stop).

Latency: Make sure that the platform has a low latency when trading, especially if are using high-frequency strategies.

9. Check for Strategy Optimization Tools

Parameter Optimization: Make sure whether the platform provides tools for optimizing strategies parameters (e.g. genetic algorithms grid search, genetic algorithms).

Machine learning: Ensure that the platform is machine learning integrated to refine and optimize strategies.

Assessment of scenarios: Determine if your platform is able of testing different strategies for various market scenarios, such as bullish, bearish, or volatile.

Review User Support for Community Reviews and Feedback

User reviews: Review user feedback to determine the platform's capacity to customize strategies.

Community forums. Find out if the users can share their knowledge and discuss their strategies in a lively community.

Support resources: Check that the platform is equipped with tutorials, documentation, and webinars that can help users create and optimizing strategies.

Bonus Tips

Trial period: Experience the platform's customisation features by using a trial or demo.

Scalability: Ensure that the platform is able to handle more complex strategies in your trading evolves.

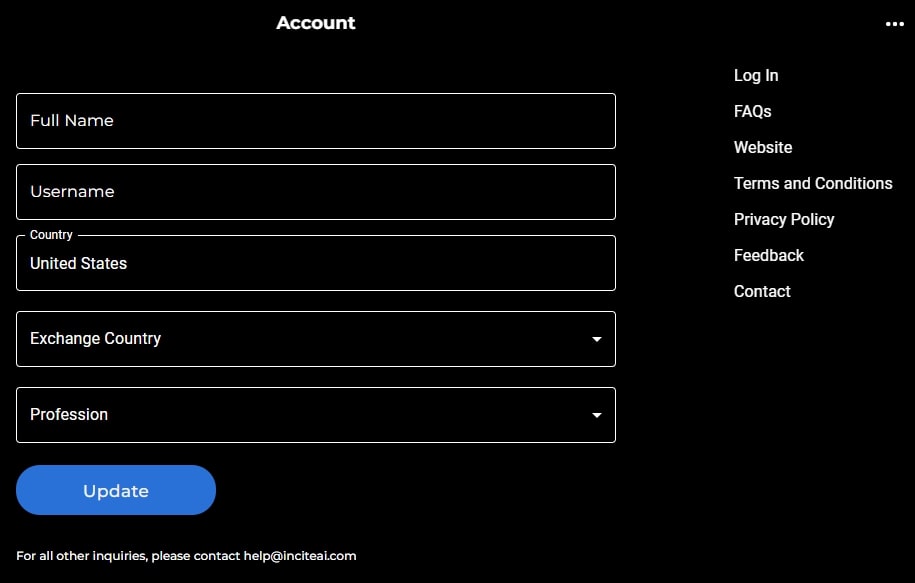

Support for customers Find out if there is support for your inquiries or concerns relating to the strategy.

These tips will help you assess the options for customization of AI trading platforms which analyze and predict the market. So you can select one that is compatible with your objectives in trading which allows you to refine and implement your strategies. Platforms with strong customization capabilities can assist you in adapting to changing market conditions, and enhance your trading performance. Check out the top rated ai stock trading bot free recommendations for blog recommendations including ai stock, using ai to trade stocks, ai investment platform, ai stocks, ai for stock predictions, ai stock trading bot free, ai stocks, ai stock trading app, ai stock, ai stock market and more.

Top 10 Tips When Evaluating The Reputation & Reviews Of Ai-Powered Trading Platforms

In the case of AI-powered platforms for trading and stock predictions It is essential to verify their reputation and reviews. This will guarantee that they are reliable as well as trustworthy and efficient. Below are the top 10 tips to evaluate reputation and reviews.

1. Check Independent Review Platforms

Look for reviews of reliable platforms, like G2, copyright and Capterra.

Why: Independent platforms can give real-time feedback from users.

2. Examine Case Studies and User Testimonials

Use the platform website to browse user testimonials as well as case studies as well as other relevant information.

What are they? They provide an insight into the performance in the real world and the user's satisfaction.

3. Assess Expert Opinions & Industry Recognition

TIP: Make sure to check if any experts in the field or financial analysts from reliable publications have been recommending or reviewing the platform.

What's the reason? Expert endorsements add an air of credibility for the platform.

4. Assess Social Media Sentiment

Tip - Monitor social media platforms such as Twitter, LinkedIn or Reddit to see comments and opinions from users.

Social media offers you the opportunity to share your opinions and news that are not restricted.

5. Verify compliance with regulations

Tips: Make sure the platform is compliant with the financial laws (e.g., SEC, FINRA) and privacy laws (e.g., GDPR).

What's the reason? Compliance assures the platform is operating legally and ethically.

6. Transparency of Performance Metrics

Tip : Check if the platform provides transparent performance metrics.

Transparency is crucial because it builds trust, and users can determine the efficacy of the platform.

7. Test the quality of customer support.

Check out the reviews for more information about customer service and its efficacy.

What is the reason? A solid support system is crucial to helping to solve problems and ensuring users have a positive experience.

8. Look for Red Flags in Reviews

Tip: Pay attention to complaints that have a tendency to recur for example, poor service, hidden charges or lack of updates.

The reason: A consistent lack of feedback could be a sign of a platform issue.

9. Assess Community and User Engagement

Tip: Make sure the platform is in use and is regularly engaging its users (e.g. forums, Discord groups).

The reason: Strong communities show that users are satisfied and continue to show support.

10. Look at the company's history

You can learn more about the company's history through research on its background the management team, its history, and its performance in financial technology.

Why? A track record with proven record increases trust and confidence on the platform.

Compare Multiple Platforms

Compare the reviews and reputation of various platforms to figure the one that is most suitable for you.

Use these guidelines to evaluate the reputation, reviews and ratings for AI stock trading and prediction platforms. See the top how to use ai for stock trading for website tips including stock trading ai, ai stock trader, investing with ai, ai trading tool, ai share trading, ai stock analysis, ai options trading, how to use ai for stock trading, ai stock predictions, can ai predict stock market and more.

Comments on “20 New Reasons On Choosing AI Stock Trading Analysis Sites”